Table of Contents

Introduction

nse raymond – In 1925, it was incorporated as the Raymond Woolen factory close to Thane Creek. Abraham Jacob Raymond and Albert Raymond are the ancestors of the brand name Raymond. This little fabric company was transformed into a well-known brand in 1958 with the help of Mr Gopal Krishna Singhania and Mr Vijaypat Singhania, who worked extremely hard.

In this blog, we cover all the critical aspects of Raymond, which will be very informative for your research.

wellhealthorganic.com:if-you-are-troubled-by-snoring-then-know-home-remedies-to-deal-with-snoring

About NSE

One of the largest integrated fabric makers in the world, Raymond Ltd (BSE: 500330|NSE: RAYMOND) located in Mumbai, Maharashtra. In India, it holds a market share of more than 60% for suits. It produces the most woolen fabrics in India. The company’s textile segment has a distribution network with over 4,000 multi-brand locations and over 637 exclusive retail stores in the domestic market alone. More than 30,000 stores sell suits in more than 400 towns around India, and a complete chain has locations in more than 150 cities. Over 55 nations, including the US, Canada, Europe, Japan, and the Middle East, are recipients of their exports of goods. It is one of the largest collections of designs and colors, having more than 20,000 different suiting fabric designs and colors.

More About Raymond

Furthermore, the operational revenue for Raymond (NSE) over the last 12 months was Rs. 8,022.64 Cr. Impressive annual sales growth of 74%, a pre-tax margin of 4% that might be higher, and a positive ROE of 11%. According to the O’Neil Methodology, the stock has an EPS Rank of 45, a POOR score suggesting inconsistent earnings, and an RS Rating of 81, a good score reflecting the overall value of the budget. The company’s 49% appropriate debt-to-equity ratio indicates a sound financial sheet. Technically, the stock is comfortably above its important moving averages, which are the 50DMA and 200DMA, respectively, by about 11% and 18%. In its weekly chart, it is currently FORMING a base and trading about 12% away from the pivot point.

Frequently Asked Questions:

1. What is the current price of Raymond shares, and how have they performed recently?

Raymond’s share cost was Rs 1,483.90 as on April 20, 2023, 03:57 PM IST. Raymond’s share cost was up by 2.71% in light of the past offer cost of Rs. 1406.5. Furthermore, In the most recent multi Month, Raymond’s share cost climbed by 17.97%.

2. What is Raymond’s market capitalization?

The market value of Raymond Share is Rs 9,878.88 Cr. Its market cap rank in the textile sector is 3.

3. What was Raymond’s share’s highest price over the previous 52 weeks?

The Raymond share’s 52-week high is Rs. 1,644.00, while its 52-week low is Rs. 737.00.

About Twitter Accounts Better Than the Hub – 2023

4. Who are the principal shareholders in Raymond?

- Promoter holding increased from 49.04 on December 31, 2021, to 49.15 on March 31, 2023.

- Domestic institutional investors’ stake increased from 4.64 (as of the end of 2021) to 5.09 (as of the end of 2023)

- Foreign institutional investors’ stake increased from 9.58 (as of the end of 2021) to 16.72 (as of the end of 2023)

- Other investor holdings decreased from 36.74 (as of the end of 2021) to 29.04 (as of the end of 2023).

5. Who are Raymond’s main rivals?

Investors frequently compare Raymond and Vardhman Textiles Ltd. for analysis within the textiles sector.

Why Service Scheduling Software Stands Out

6. What primary measures are used to evaluate the Raymond Share Price?

Raymond’s essential metrics are:

- Raymond’s PE Ratio is 16.52.

- Raymond’s earnings per share are 89.81 cents, and its price-to-sales ratio is 0.92. Its price-to-book ratio is 3.95.

Which is better for Raymond: to buy or to sell?

According to Refinitiv (formerly Thomson Reuters), the four analysts’ average overall rating for the Raymond stock is Strong Buy. Moreover, the recommended separation is as follows. Strong Buy is the recommendation of 4 analysts.

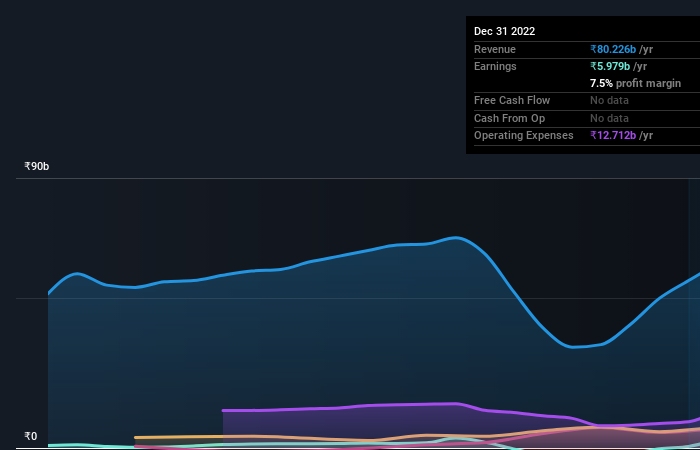

Raymond Financial Income (P&L)

| QUARTERLY | ANNUAL | DEC 2022 | SEP 2022 | June 2022 | MAR 2022 | DEC 2021 |

| Absolute Income | 2,199.53 | 2,190.85 | 1,754.40 | 2,031.74 | 1,870.88 |

| Absolute Pay Development (%) | 0.40 | 24.88 | -13.65 | 8.60 | 18.17 |

| Absolute Expenses | 1,911.36 | 1,900.36 | 1,578.06 | 1,843.76 | 1,629.41 |

| Absolute Costs Development (%) | 0.58 | 20.42 | -14.41 | 13.16 | 13.27 |

| EBIT | 288.17 | 290.49 | 176.34 | 187.98 | 241.47 |

| EBIT Development (%) | -0.80 | 64.73 | -6.19 | -22.15 | 66.82 |

| Benefit after Duty (PAT) | 94.84 | 158.86 | 80.90 | 263.31 | 100.28 |

| PAT Development (%) | -40.30 | 96.37 | -69.28 | 162.57 | 88.28 |

| EBIT Edge (%) | 13.10 | 13.26 | 10.05 | 9.25 | 12.91 |

| Net revenue (%) | 4.31 | 7.25 | 4.61 | 12.96 | 5.36 |

| Essential EPS (₹) | 14.25 | 23.86 | 12.15 | 39.55 | 15.06 |

Raymond Financial Balance Sheet

| ANNUAL | FY-2022 | FY: 2021 | FY-2020 | FY: 2019 | FY 2018 |

| Complete Assets | 7,376.56 | 6,740.25 | 7,747.14 | 6,664.45 | 6,108.98 |

| Complete Resources Development (%) | 9.44 | -13.00 | 16.25 | 9.09 | 16.31 |

| Complete Liabilities | 4,940.25 | 4,560.97 | 5,282.74 | 4,627.68 | 4,220.70 |

| Complete Liabilities Development (%) | 8.32 | -13.66 | 14.16 | 9.64 | 20.25 |

| Complete Equity | 2,436.31 | 2,179.28 | 2,462.55 | 2,036.77 | 1,888.28 |

| Complete Value Development (%) | 11.79 | -11.50 | 20.90 | 7.86 | 8.37 |

| Current Proportion(x) | 1.29 | 1.26 | 1.03 | 0.97 | 1.00 |

| Complete Obligation to Value (x) | 0.88 | 0.90 | 0.92 | 1.10 | 1.00 |

| Contingent Liabilities | 784.70 | 643.84 | 578.43 | 639.63 | 233.78 |