sbi cibil score for personal loan – A CIBIL score is a three-digit number that sorts from 300 to 900. It measures your creditworthiness or how likely you are to repay a loan on time. Lenders use your CIBIL score to assess your risk and decide whether to approve you for a loan.

Table of Contents

What is the CIBIL score required for an SBI personal loan?

SBI does not publicly disclose the CIBIL score required for a personal loan. However, it is generally accepted that a score of 750 or above is considered good for loan approval. A score of 650 or above may also be sufficient, depending on your other financial circumstances.

The minimum CIBIL score required for an SBI personal loan is 650. However, a higher CIBIL score will progress your chances of getting approved for a loan and getting a lower interest rate. A CIBIL total of 750 or above is considered good for loan approval.

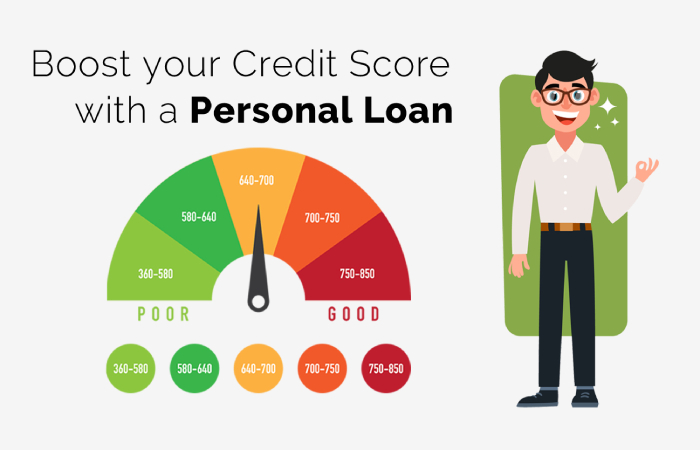

Here is a table showing the CIBIL score ranges and their corresponding meanings:

| CIBIL Score Range | Meaning |

| 300-579 | Poor |

| 580-669 | Fair |

| 670-739 | Good |

| 740-799 | Very Good |

| 800-900 | Excellent |

Your CIBIL score is based on your acclaim present, which includes information such as your fee history, credit utilization, and the measurement of your credit history. A good credit history will help you get a high CIBIL score, making getting approved for loans and other forms of credit easier.

You can check your CIBIL score for free once a year from the CIBIL website. You can also get your CIBIL score from other websites, but you may have to pay a fee.

If you have a low CIBIL score, there are things you can do to improve it. You can pay your bills on time, keep your credit utilization low, and extend the length of your credit history. You can also get a tenable credit card, which is a kind of credit card that requires you to deposit a security deposit. This can help you build your credit history and advance your CIBIL score.

How can I improve my CIBIL score?

There are a few things you can do to improve your CIBIL score:

* Pay your bills on time. This is the most important factor in determining your CIBIL score.

* Keep your credit utilization low. This means using no more than 30% of your available credit.

* Don’t apply for too many loans in a short time. This can have a negative impact on your score.

* Dispute any errors on your credit report.

How do I get my CIBIL score?

You can get your CIBIL score for free from CIBIL once a year. You can also get your score from other websites and credit bureaus, but these services may charge a fee.

The minimum CIBIL score required for an SBI personal loan is 650. However, a score of 750 or above is considered to be good for loan approval. The exact CIBIL score required for loan approval may vary depending on other factors such as your income, employment history, and debt-to-income ratio.

Benefits of having a good CIBIL score

A good CIBIL score can have many benefits, including:

- Higher chances of loan approval: Lenders are more likely to approve loans to borrowers with good credit scores. This is because borrowers with good credit scores are seen as less risky, and therefore more likely to repay their loans on time.

- Lower interest rates: Lenders may offer borrowers with good credit scores lower interest rates on loans. This is because borrowers with good credit scores are seen as being less risky, and therefore less likely to default on their loans.

- Longer loan terms: Lenders may offer borrowers with good credit scores longer loan terms. This means that borrowers with good credit scores may be able to repay their loans over a longer period of time, which can make the monthly payments more affordable.

- Higher credit card limits: Lenders may offer borrowers with good credit scores higher credit card limits. This means that borrowers with good credit scores may be able to spend more money on their credit cards before they reach their credit limit.

- Pre-approved loan offers: Lenders may send borrowers with good credit scores pre-approved loan offers. This means that borrowers with good credit scores may be able to get a loan without having to go through the full application process.

- Better negotiating power: Borrowers with good credit scores may have better negotiating power when it comes to getting a loan. This is because lenders are more likely to be willing to negotiate with borrowers who have a good credit score.

Additional Benefits

- You are more likely to be approved for a loan.

- And also you will get a lower interest rate on your loan.

- You will have more options when it comes to loans.

- You will be able to build your credit history.

Tips for Maintaining a Good Civil Score

Here are some tips for maintaining a good CIBIL score:

- Pay your bills on time. This is the most important factor in determining your CIBIL score.

- Keep your credit utilization low. Your credit application is the amount of credit you use compared to the total amount of credit you have available. Aim to keep your credit application below 30%.

- Don’t apply for too many loans or credit cards in a short period of time. This can hurt your credit score.

- Dispute any inaccurate data on your credit report. If you see anything on your credit report that is incorrect, you can argument it with the credit bureau.

If you are looking to improve your CIBIL score, there are a few things you can do:

- Pay your bills on time.

- Keep your credit utilization low.

- Don’t apply for too many loans at once.

- Dispute any inaccurate information on your credit report.

Conclusion

Overall, having a good CIBIL score can make it easier to get approved for loans, get lower interest rates, and have more flexibility when it comes to your finances. You can get your CIBIL score for free once a year from CIBIL. You can also get your CIBIL score from other websites, but you may have to pay a fee.